In my daily meetings with contractors, I encounter plenty of self-delusion. It comes in many forms, but I see these four types most often.

1. My labor costs are covered. This affects all jobs, whether they are T&M or contract price. With T&M, the labor component is sold at an hourly rate. Too often this is based not on actual labor costs, but on what the contractor thinks will match or undercut the competition and be acceptable to his customers.

With a contract price, labor is included among the estimated costs for the job. But if the labor costs are incorrect, then when a markup is applied, it will be inadequate to generate the desired gross profit.

This delusion stems from not understanding that the hourly rate you charge for an employee is much higher than what you pay the employee. The added cost comes from payroll taxes, benefits, and other employee-related expenses commonly lumped together into what is called “labor burden” (see “Calculating Labor Cost,” Feb/02). The difference can be jaw-dropping. I remember briefing both the owner and the bookkeeper of a remodeling company about how to use a labor-burden calculator I created in Microsoft Excel (there are many available free of charge online). On our next call, the usually quiet owner nearly blew my eardrum out by shouting, “Do you know what it costs me for an hour of labor? I have to start charging more!” Mission accomplished.

2. At least I broke even. I’ve lost track of how many times a contractor has said to me, “Yeah, that job was a mess, but at least I didn’t lose money on it.” What they mean is that their costs for material, labor, and subcontractors were covered by what the customer paid for the job. But if overhead wasn’t covered, money is being lost.

For example, imagine that a job lasts for six weeks, and payments from the homeowner cover job-cost expenses but not overhead. Assuming $1,000 per week in overhead (most construction or remodeling companies have at least $52,000 in annual overhead), the contractor will lose $6,000, to say nothing of the profit that the job should have contributed.

3. One big job will fix everything. One of my clients once claimed that the profit on a big job would be so enormous that he could afford to price it at a lower margin and that it would also make up for shortfalls in the smaller jobs he had completed to date. There are a couple of problems with this thinking.

First, a small job is short enough that any production inefficiencies—such as scheduling issues, material delays, or poor field-office communication—don’t have time to lead to catastrophe. But remodelers who do very well with jobs in the $50,000-to-$80,000 range may find that a $1.1 million “windfall” job changes all the rules.

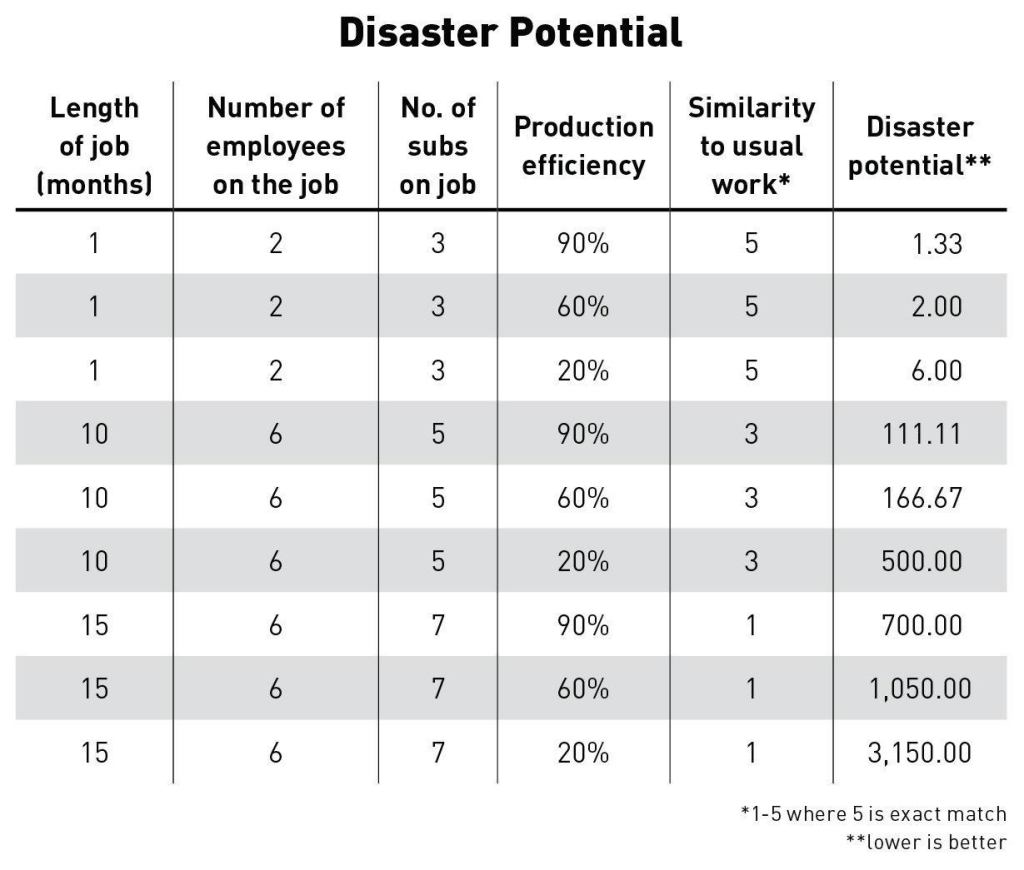

My rule of thumb is that a company’s inefficiencies and poor practices will be magnified according to a job’s size and how different it is from a typical job (see table, “Disaster Potential”). I measure job size by its duration and the number of employees and subs involved. How similar a job is to other work is a subjective assessment of how much the job will stretch you and your crew beyond what you’re comfortable doing on a regular basis. For example, if you specialize in remodeling 5×8 bathrooms, building a new 5,000-square-foot home would be a big difference.

Second, a larger job introduces a learning curve. For example, it can involve learning how to coordinate a larger crew, or how to collect money over a longer period of time to keep cash flowing into the business.

4. I’ll make it up on the next job. Many contractors and remodelers are embarrassed by profit. Yes, they want it, but they’re more driven by a desire to create beautiful, quality work and to have a delighted customer who feels like a good friend. To this end they’ll give away what should be charged as change orders and “make right” every customer disappointment no matter what the cost. Too often this kind of behavior promotes a companywide culture that takes “the customer is always right” to nonsensical—and unprofitable—lengths. The rationalization is that the next job will somehow run perfectly (it rarely does), be sold at a high enough price to make up for past less-profitable jobs (it probably won’t), and produce sufficient profit to cover what the earlier jobs failed to yield (it almost never will).

Let’s look at the numbers (see table, “Making Up for a Shortfall”). To keep things simple, let’s assume that you sell four jobs for $100,000 each. Your production costs average $74,000. When you’re done with the four jobs, you have $400,000 in sales and have an achieved gross margin of 26% (104 ÷ 400). You’ve read or heard that your margin should be more like 30%, so that’s your target. Now you need to “make up for” the lost margin in your next job. Assuming that it’s a similar job with similar costs, you’d have to sell it for $130,000, nearly a third more than the price you’re used to selling. What are the chances you can actually do that?