Break-Even Dollars vs. Number of Projects

This per-project calculation is a good yardstick if all of your jobs are similar, as they might be if you only do room additions, or only build new homes. But what happens if you handle projects ranging from small handyman jobs to whole houses, as many of you do? In that case you need to think in terms of contribution dollars, not just number of projects.

If you’re a specialty or replacement contractor — if you do decks, roofing, siding, replacement windows, basement finishing, and the like — you can think in terms of installed square footage or installed units per month or quarter. If a square of vinyl siding installed had an average selling price of $250, a gross-profit percentage of 40 percent, and a contribution margin of 31.6 percent, each installed square would contribute $79 toward your monthly “nut” of $11,770 and you would need to install and collect for 149 squares per month to keep the doors open.

Note that your break-even calculations should be based on your own history whenever possible. Smaller jobs will probably have lower site expenses (you may not need a dumpster or a Porta-John, for example.)

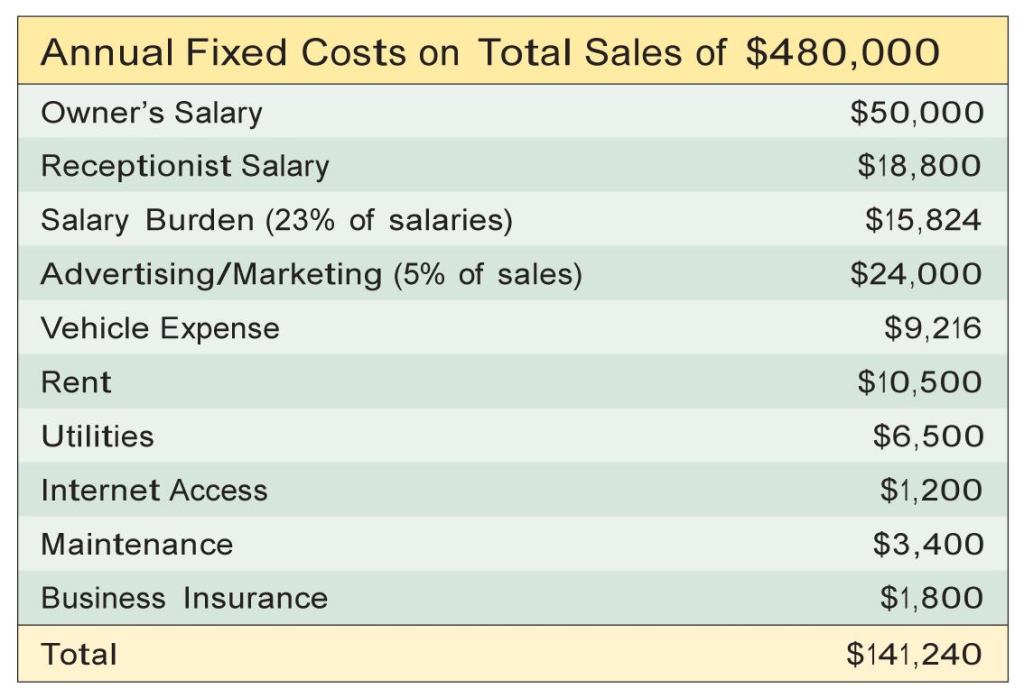

Break-Even Analysis

If you don’t like the break-even numbers you’re coming up with, try some calculations using a higher gross-profit margin or lower fixed costs to see what happens if you could increase efficiency or were able to raise prices. As I mentioned last month, it’s gross profit that drives business, not your bottom line. If you still don’t believe me, lower your GP a few points and run the break-even calculations again; you’ll be surprised how much harder you’ll need to work to keep your doors open.

In this month’s example, if we make our gross-profit margin 30 percent rather than 40 percent, our contribution margin drops to only 21.6 percent, which means that we would have to complete and collect for more than eight average projects instead of six.

This break-even analysis is something you should be doing on a regular basis. It’s the best way to ensure you’re selling enough work at a high enough margin to cover your annual expenses and still earn the bottom-line profit you need to reach your financial goals. To help, I’ve uploaded an Excel break-even calculator to the library of the Business Technology forum at jlconline.com.

JLC contributing editor Joe Stoddard moderates the Business Technology forum at jlconline.com.