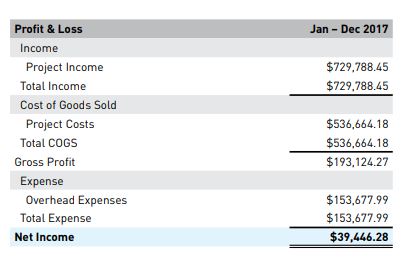

Let’s say when you look at your profit and loss statement, it shows a net profit of $39,446.28. The logical assumption is that you have at least $39,000 sitting in your various bank accounts ready to use, right? Well, as usual in accounting, things aren’t quite that simple. In addition to the profit and loss statement, there are two other primary financial reports—the balance sheet and the statement of cash flows—and each has a different purpose and tells a different part of the story. In her JLC article “Where’s the Cash?”, business consultant and coach Melanie Hodgdon examines how these reports all contribute to the story of how much money you have.

As Hodgdon explains, the answer to the question “Where’s my cash?” is more complex than it appears on the surface. While most people are comfortable using and interpreting the P&L, it doesn’t show the full story—it doesn’t include investments made (such as purchasing vehicles and equipment), payments on loans, and withdrawals from the company for personal use. Next time you look at your bottom line and wonder where the cash is, check out the statement of cash flows report; it will tell you exactly where your money went. To read the full article, click here.