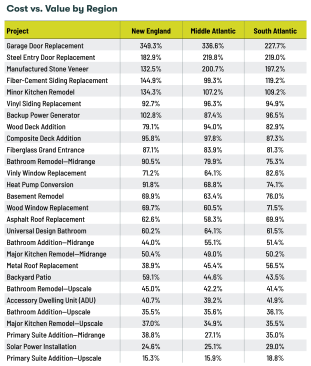

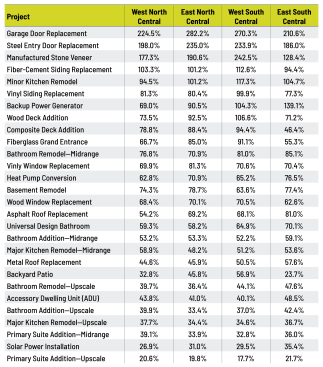

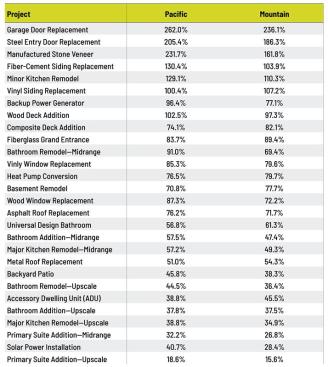

Zonda’s 38th annual Cost vs. Value (CVV) report provides insight into the home renovations that deliver the best return on investment. This year’s report confirms a consistent truth in the remodeling market over the last two decades: Exterior renovations deliver a higher return on investment (ROI) than discretionary interior remodels. This outcome is partly based on values defined by real-estate professionals, who tend to place high value on a home’s curb appeal when establishing a home’s selling price, and partly on the lower labor costs for exterior replacement projects, which are far less skill-intensive than complex interior kitchen and bath remodels and additions.

Of the top 10 projects with the highest ROI, eight are exterior replacement projects, with a new garage door taking the top position for the second year in a row. Replacement of an entry door with an insulated steel unit and installation of a manufactured stone “skirt” across a home’s front façade fill out the number two and three positions, respectively. The two siding projects have both risen two notches on the National Averages list, with the fiber-cement replacement project at position four and vinyl siding at six.

One exception to the exterior projects trend, sitting at position five, is the minor kitchen remodel—a modest kitchen face-lift that updates what is widely seen as the most important room in the house. Many homebuyers want a kitchen they can live with until they can afford to undertake a more extensive remodel to realize their “dream kitchen.”

Indeed, the more complex the project, the lower the return on investment at the time of house sale. This doesn’t mean that bigger discretionary projects, such as full bathroom and kitchen remodels and additions, don’t have value to the homeowner investor. It’s important to remember that the Cost vs. Value report answers a specific question: What value does a particular remodeling project add to the sale price of a home? This is only one kind of value that remodeling projects provide. Large discretionary projects with specific cabinets, counters, finishes, appliances, and hardware chosen by the homeowners will have an undeniable positive value to those homeowners for as long as they occupy the home. But the specific selections made by one homeowner may be less appealing to a wide range of prospective homebuyers. And, of course, these larger, more complex projects cost much more, so as a ratio of value over cost, expensive projects with less universal appeal will have a lower ROI.

The other exception to the exterior replacements trend in the top 10 projects is the installation of a backup power generator, sitting at position seven on the National Averages list. While no region seems immune from an ailing electrical grid and severe weather, the regional variability of this project bears attention: In the southern regions with hurricane-prone Gulf states and in New England, backup power yields the highest ROI—north of 100% and as high as 139% in the East South Central region. Whereas in the West North Central region, the ROI for a backup power generator is the lowest at 69%.

Increasing ROIs for Select Projects

Compared with last year’s CVV reports, 2025’s has seen a surge in several project values, with the average values of the top three projects—the garage door and steel entry door replacements and manufactured stone veneer—worth more than double their investment cost.

Such high returns may be attributed to the difficult market for existing homes we have in today’s economy with consumer sentiment shifting from concern over rising mortgage rates (the driving concern last year) to fear of economic uncertainty. “If the cohort of discerning buyers characterized last year’s homebuyers,” says Todd Tomalak, principal, advisory of building products at Zonda, “this year’s buying pool is even more discriminating. The majority [of homebuyers] are hesitating, leaving only a small pool of very selective homebuyers.” Long gone are the days when homebuyers would snap up homes regardless of condition. The few homes that are moving in today’s market tend to be ones in solid condition with well-appointed exteriors, and they are moving at high prices. In this climate, a new garage door or refreshed exterior façade can go a long way toward attracting buyers with the means to buy a house at top dollar.

Regional Variance

“Location, location, location” is rarely disputed to be the first principle of real-estate sales, and the Cost vs. Value report delivers on this rule by providing data for 150 metro areas. Zooming out to the regional view gives broad insight into some of the regional diversity in project returns.

When the results from all the projects are combined, the Pacific region shows the highest average return. The West South Central region comes in second, supplanting New England for the first time in CVV’s 23-year history. In both regions, real-estate professionals report higher values on projects with only modestly higher costs. ROIs in the Middle Atlantic and East North Central regions grew stronger than returns in the South Atlantic and Mountain regions in the latest report.

New Projects

In addition to the backup power generator, this year’s CVV report features several other new projects, including remodeling a basement, building an accessory dwelling unit (ADU), and adding solar panels to the roof.

At an ROI of 71% as a national average, the basement remodel returns the most among these new projects. This ROI remains reasonably consistent across all regions, with a variation of 14 percentage points (compared to a variation of 70 points for the backup power generator).

The installation of solar panels on the roof, with an average cost only slightly above the basement remodel and backyard patio projects, was poorly valued by real-estate professionals and delivered the second lowest return on investment on a national basis. Regionally, these ROIs were the highest in the Pacific (40.7%) and East South Central regions (35.4%) and the lowest in New England (24.6%)—a variation of 16%.

CVV for Building Professionals

While the CVV report is designed to track project values relative to the price of existing homes, building professionals are focused on more than resale value when they begin discussing a project budget with prospective clients. Design and craftsmanship, occupant health and safety, long-term durability, reductions in liability, and potential for repeat business are all top of mind for professional remodelers entering into a new project. But all these factors, and the different values attached to them, are not necessarily understood by clients.

Cost vs. Value gets the conversation started. By focusing first on the value of the client’s investment, defining it the way a broker might, remodelers can zero in on a client’s biggest anxiety: cost. Instead of leading with their prices, remodelers can first deliver a generalized cost that demonstrates that the project being considered will provide a definite return. Once that’s established, the contractor can go on to show the client how to think like a remodeler, raising the client’s understanding and appreciation of the total value of a company’s work. As customers get used to this positive mindset, remodelers can move the conversation forward to reveal the specific price for the project at hand.

The cost data in the Cost vs. Value report does include a standard markup of 10% on materials and 10% on labor. This is a starting point. It may be considered low by many contractors who build high value into their work with things like a well-paid workforce that receives good benefits to ensure that a high level of dedicated, skilled, and trustworthy talent will be working on the project. Those are the type of details that contractors will discuss with clients as they work to broaden the definition of home value and distinguish their company as the best one to complete the project.