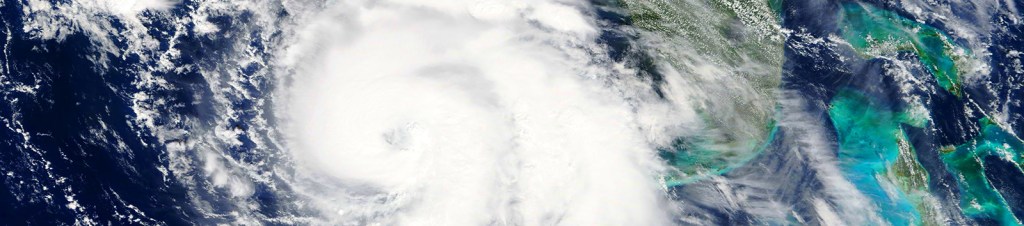

Now that hurricanes Harvey and Irma have wrought billions in damages, it’s time for contractors to come in and do the necessary repair work. But restoration work differs from typical contracting in a number of crucial ways. And working with insurance adjusters is the first thing many contractors will need to understand — or risk becoming casualties themselves.

“When you go in there green, and you don’t know anything it’s a very dangerous game to play,” warned Peter Crosa, an independent adjuster for 40 years who’s also written several books to help contractors understand how to work with adjusters. He’s also former president of the National Association of Independent Insurance Adjusters, which insurance companies use in disaster situations.

So just what is an independent adjuster? In essence, these are the go-betweens to insurance companies. Adjusters decide how much a claim is worth — and ultimately when and how much a contractor gets paid.

Crosa offers these eight tips to help contractors have profitable working relationships with adjusters:

1. Offer services

Homes in catastrophe situations need immediate help. So adjusters need contractors who can simply plug holes in roofs, windows, and siding. Unlike other repair work, adjusters don’t need detailed estimates for the work. Typically they can simply estimate hours and materials. The work is easy and usually at least nets a couple thousand dollars. Not only can this work be lucrative, but it also helps contractors get a foot in the door with adjusters. That will make getting future work easier and negotiating estimates less combative.

2. Be detailed

When you submit a full restoration proposal make sure it details what you propose comprehensively by square foot or squares of materials layer by layer. It should also include a breakdown of labor and material costs. A typical one-page proposal that says, “repair roof” is not going to be acceptable. Ideally, adjusters need to see a computerized estimate that breaks down the proposal into minute details. The best bet is to use the same estimating software as adjusters. In the insurance world that means Xactimate, which 90 percent of adjusters use.

3. Work together

Walk through the job with an adjuster and scope it together. That way you’re comparing apples to apples. Contractors who scope the job on their own simply won’t know what the adjuster deems acceptable to replace and repair. Conversely, it’s easier to make a case for repairs when the adjuster can see what you’re pointing out. So make an extra effort to schedule walk-throughs and estimates with adjusters.

4. Distinguish between adjusters

Remember, there are two kinds of adjusters: wind and flood. Wind adjusters won’t deal with any flood related issues and vice versa. When you encounter an adjuster ask them which type they are. Wind adjusters are more likely to be in a position to pay claims since most insurance covers wind damage. However, flood adjusters are typically with FEMA, which means getting paid will be slower and more difficult. Sometimes there will be no flood coverage at all, which makes getting paid for repairs even less likely.

5. Get details right away

As soon as you start work, make sure you know who the insurance company is, the policy number, and the name and contact information for the adjuster. That last point is crucial because a lot of adjusters are going to be temp employees. When they’re done with the job they’re gone, often to another state. So having detailed contact information is crucial to being able to track them down for follow up questions and prompt payment.

6. Document and authorize

Don’t start any work until you have all the documentation properly signed. Make sure you have a written proposal and a signed contract with a clear direction for the homeowner to pay you directly. Essentially, make sure all the contracts you normally use are documented and signed. In a hurricane situation, it’s too easy to try to be the good Samaritan and get burned because you don’t know who’s going to pay. Even after the job is completed, make sure to get work satisfactions signed and copies of those to the insurance company, property owner, agent, and adjuster.

7. Understand who’s paying you

You have to bill the property owner but it may take some follow up calls to the adjuster to actually get paid. This is where having a good relationship with adjusters pay off. In a catastrophic situation, adjusters may be authorized to issue checks up to $100,000. But if you’ve made their life difficult they can also bury your payment in red tape. A good turn around for payment would be 30 days; mediocre would be 60 days. If you hit 120 days there’s likely an issue the adjuster isn’t sharing with you. So you’ll need to find out what’s holding up the payment. In some cases, you may need to use legal recourse to get paid.

8. Know your place

Debating adjusters about insurance policy coverage is a no win. Having that argument will turn an adjuster off right away. Even if you’ve taught insurance classes do not try to argue with an adjuster about coverage. Instead, stay in your lane and provide professional estimates that detail and justify your costs.