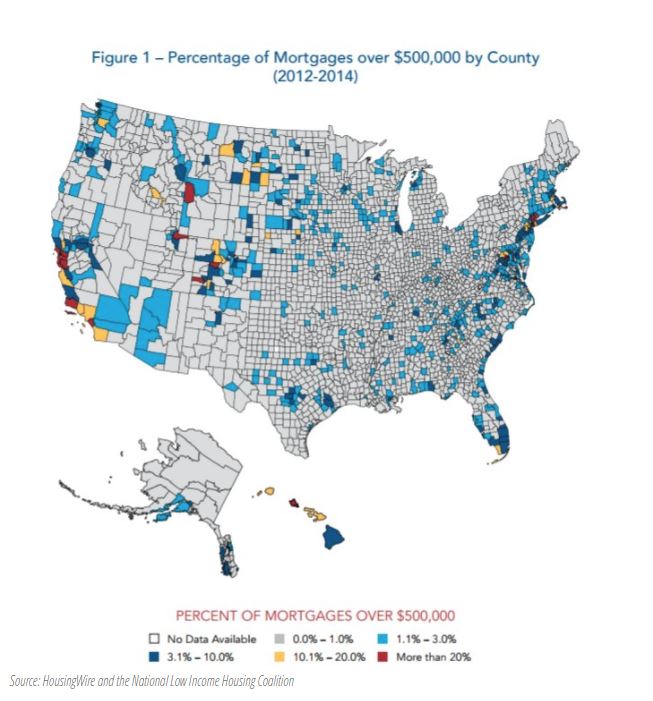

The Republican leadership has offered a tax reform plan to cut business, individual, and estate taxes by $1.472 trillion, that it says is a grand bargain to transform the code to a degree not seen in more than three decades. But as John McManus of Builder writes, ‘When it comes to the mortgage interest deduction, there won’t be winners and losers. There will be losers and bigger losers. Namely, people who work for and aspire to homeownership, and people whose livelihoods depend on developing and building and selling homes and communities. The National Association of Home Builders illustrates the impact that capping the mortgage interest deduction to loan amounts of less than $500,000 will have here, noting that if the GOP plan becomes effective as is, the number of Americans using MID will shrink from 34 million to 10 million.’

GOP Plan: Divide and Conquer on Mortgage Interest Deduction

1 MIN READ